Risk Management

- Corporate Governance Structure

- Basic Internal Control Policy

- Compliance

- Risk Management

- Disclosure Policy / IR & SR Policy

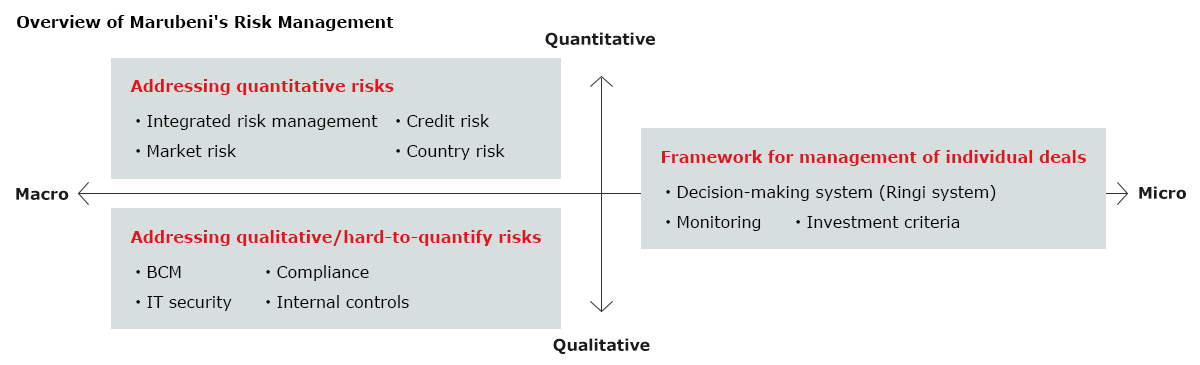

As the business environment surrounding Marubeni changes daily and uncertainties increase, Marubeni’s competitiveness is key to appropriately responding to change and clearly identifying opportunities and risks as they appear. As it engages in a broad range of business activities globally, Marubeni manages diverse risks from multiple approaches, such as macro, micro, quantitative and qualitative perspectives. The Company has had a basic policy and internal rules in place for managing risks from each perspective, and keeps up to date its organizations, management structures and management methods to enable effective risk management.

Zoom

Integrated Risk Management

Marubeni practices integrated risk management across its diverse operations spanning a broad range of sectors and geographic areas. In conducting integrated risk management, the Marubeni Group calculates maximum downside risk (risk assets) as a multiple of the estimated maximum loss based on the risk profile of each asset type, to understand its exposure to risks on a consolidated basis. The Group’s basic policy is to keep risk assets within the range of its equity, which represents its risk-bearing capacity. Currently, the amount of risk assets calculated in this manner is within its equity.

Management of Individual Deals, Investment Decision-Making Process

For individual deals such as significant business investments, Marubeni has a risk management regime spanning every step from entry through exit-based consensus decision-making and monitoring.

With regard to new deals, business groups must first submit project summaries and business plans. In response, the relevant corporate staff groups submit opinions on the result of risk analyses from both a quantitative and qualitative perspective. They are then discussed by the Investment and Credit Committee. The Investment and Credit Committee applies PATRAC*, the risk-adjusted profit after tax, as one guideline for quantitatively evaluating the deal while taking into account the feasibility of individual deals, risk analyses and company-wide concentration risks. The deal is then forwarded to the Corporate Management Committee for further scrutiny and approved by the President. Deals that exceed a certain materiality threshold are approved by a Board of Directors’ resolution.

PATRAC (Profit After Tax less Risk Asset Cost): A performance indicator developed by Marubeni to measure the extent to which returns exceed a minimum risk-adjusted return target

Once an investment has been made, the business group monitors it. Highly material investments, however, are monitored more closely to facilitate early problem detection and corrective action. The Investment and Credit Committee, Corporate Management Committee and the Board of Directors periodically receive reports on the current status of investments. The strategic, growth and profit potential of these investments is examined, with necessary investments considered from a variety of multifaceted angles and the determination regarding whether to revise and move forward or withdraw made in accordance with a consensus-based decision-making process.

Business Continuity Plans (for business continuity in the event of a major disaster)

Marubeni updated its Business Continuity Plan (BCP)*1 as of April 1, 2022. Previously, management developed the BCP by scenario such as earthquakes, an emerging infectious disease, and the total loss of corporate functions in Tokyo. As risks have diversified lately, the scenario-based approach of the former BCP was not enough to cover all kinds of risks. For this reason, Marubeni implemented an All-Hazards BCP, an impact-based approach that can quickly respond to a wide range of crisis events.

In this BCP, management has identified critical resources such as employees, systems, offices (buildings), payment functions, and critical resources related to the management of Group companies. By identifying common responses to these essential resources, our BCP can be better positioned to address various risks.

Marubeni has newly founded an organization dedicated to establishing and promoting a BCM*2 system during normal times to effectively implement the BCP during a risk event. This organization periodically conducts trainings for the Headquarters crisis management team and improves the BCP.

Moreover, in the event of possible damage to a critical resource of our Group companies, said damage might impact our customers and Marubeni’s consolidated financial statement. For this reason, Marubeni believes it is necessary to support business continuity at our Group companies and is helping domestic Group companies establish their own BCM systems.

1 BCP (Business Continuity Plan): A plan to quickly recover from damage and to minimize the loss of critical resources during a risk event

2 BCM (Business Continuity Management): A management system for developing, implementing, and improving the BCP and for conducting trainings during normal times

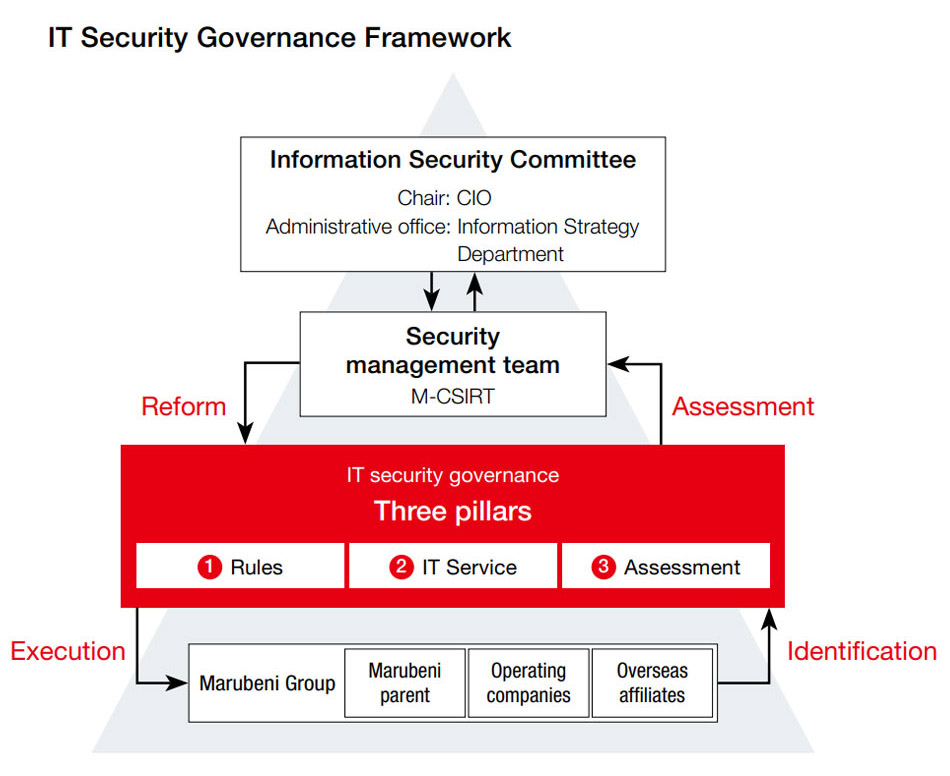

IT Security

Marubeni aims to reduce Groupwide security risks through an IT security governance framework. Marubeni has established the Information Security Committee, chaired by the CIO, to formulate response policies and identify security issues. The Company has also created systems for responding to security incidents with security management teams that comprehensively take care of incidents. Marubeni takes a three-pronged approach to IT security. 1 IT governance rules for information security are shared among and strictly followed by Group companies. 2 In principle, all Group companies are provided with secure, shared IT services based on these rules. 3 Assessments of compliance with IT governance rules are periodically conducted.